In the complicated healthcare billing and revenue cycle management world, denial management is often challenging. Claim denials happen due to coding errors, lack of pre-authorization, or incomplete information. The American Medical Association (AMA) report says that denial rates for major commercial payers varied from 1.63% to 9.6%, with rates reaching up to 23% for Medicare.

This comprehensive blog gives a straightforward and step-by-step approach to handling denials. The blog has everything from understanding the root causes to developing actionable solutions.

Definition and claim denial types

Claim denials are occur when a payer rejects a healthcare provider's request for payment. There can be numerous causes of denials, ranging from documentation errors to failure in meeting specific requirements set forth by the payer.

Types of denials in RCM

Denials are mainly classified into two types: soft and hard. Soft denials have minimum technical errors and are easy to correct. Hard denials are related to clinical issues that are difficult to appeal.

Soft denials

If the insurance claim is denied by a plan for procedural or administrative reasons, it is soft denial. Soft denials are temporary and can be resubmitted with additional clarification or information.

Hard denials

Hard denials demand a formal appeal from the provider and usually results when:

- The provider fails to take prior authorization for the services rendered

- If services are not covered in the insurance plan

- If the claim is filed late

Hard denials are further classified into two types: clinical and preventable denials.

- Clinical denials occur when the payer refuses reimbursements due to incorrect coding, uncovered services, or lack of necessity.

- Preventable denials can be avoided with proper documentation, correct coding, timely claim submission, and accurate patient information.

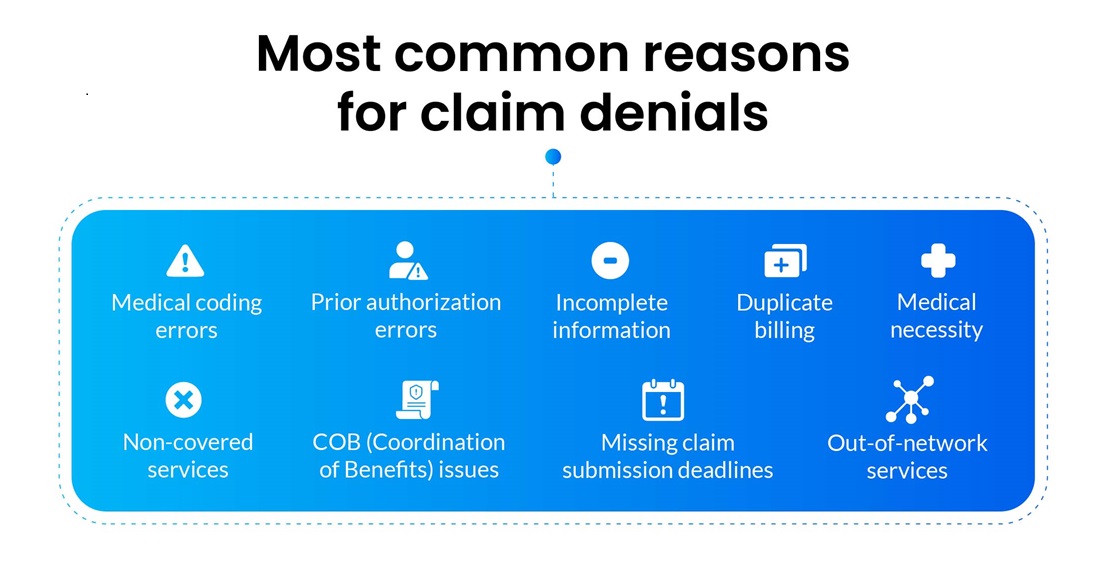

Medical coding errors

One of the most prevalent reasons for denials is errors in medical coding. These errors can include incorrect use of CPT (Current Procedural Terminology), ICD (International Classification of Diseases) codes, or modifiers. Up-coding and under-coding also act as significant reasons for coding denials.

Lack of prior-authorization

According to a report by NIHCR, physicians lose around $80,000 every year as they fail to obtain prior authorization for the services rendered to patients. Some medical procedures or treatments require prior authorization from the insurance company before they are performed. Failure to get this pre-authorization can result in the denial of the claim.

Incomplete information

Claims get denied if they lack essential information, such as patient details, diagnosis codes, dates of service, or required documentation. Incomplete forms or missing signatures can also lead to denials.

Duplicate billing

Submitting the same claim multiple times for the same service or procedure can trigger denials. Payers flag duplicate claims as potentially fraudulent or erroneous, which can even result in audits.

Non-covered services

Insurance policies may not cover certain services, procedures, or medications. If a claim is submitted for a non-covered service, it will likely be denied.

Missing claim submission deadlines

Payers have specific deadlines within which claims must be submitted. Failing to submit a claim within these time limits can result in automatic denials.

Medical necessity

Payers assess whether a procedure or treatment is medically necessary based on the provided documentation. If the documentation does not support the service's medical necessity, the claim gets denied.

Coordination of benefits (COB) issues

When a patient has multiple insurance coverages from Medicare and Medicaid, the coordination of benefits must be managed appropriately. The inability to do so can lead to denials.

Out-of-network services

If a patient seeks services from providers out of the insurance network, the claim may be denied or processed at a reduced rate.

What is the impact of claim denials?

According to AAFP (American Academy of Family Practice), claim denials between 5-10% lead to billions of dollars in lost revenue annually. It's crucial to note that each type of denial carries its consequences. These may include delayed payment, increased administrative costs due to rework, strained patient-provider relationships, and potential regulatory scrutiny.

Delayed cash flow

Claim denials directly impact a healthcare provider's cash flow. Each denied claim represents delayed or potentially lost revenue, affecting the healthcare organization's financial stability.

Increased days in accounts receivable (AR)

Denials prolong the time it takes for healthcare providers to receive payment for services rendered. This, in turn, leads to an increase in the average number of days in accounts receivable.

Administrative costs

The process of reworking denied claims incurs additional administrative costs. Staff spend more time identifying, rectifying, and resubmitting claims, which can be spent on delivering valuable patient care.

Reduced profit margins

With a higher rate of denials, healthcare providers see a direct impact on their bottom line. Reduced reimbursements and increased costs associated with denials can also affect profit margins.

Impact on small practices

Smaller practices or clinics with limited resources are exceptionally vulnerable to denials. If the denial rate exceeds 5%, it can significantly impact their financial viability. Understanding the financial repercussions of claim denials is the first step in streamlining RCM. By implementing effective strategies to identify, address, and prevent denials, healthcare organizations can safeguard their revenue streams and ensure long-term financial health.

How do we avoid claim denials?

According to Beckers, 65% of claim denials are never worked upon, resulting in an estimated 3% net revenue loss. Healthcare providers can mitigate the financial risks of denied claims by creating a proper denial management strategy. They can focus on comprehensive documentation and empower staff through targeted training. Here are proven ways to avoid claim denials.

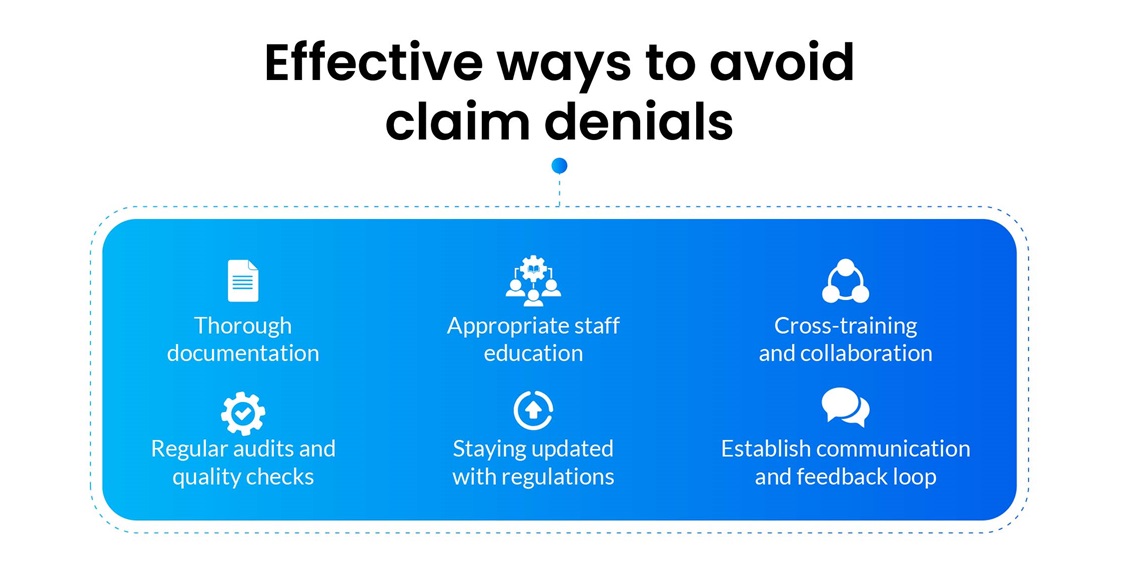

Thorough documentation

Thorough documentation is vital for successful claims processing. It ensures that proper details of diagnoses, treatments, and procedures performed are submitted to the payers. While documenting, healthcare providers must verify any pre-authorizations, referrals, or prior approvals for systems or services. Healthcare providers must also update patient records with conditions, treatments, or medication changes.

Appropriate staff education

Awareness of common denial reasons empowers staff to manage them proactively. Healthcare practices should train billing and coding staff on accurate code selection and documentation. Staff must also be aware of claim submission deadlines and have access to essential resources such as code books, online references, and coding guidelines. Understanding the significance of obtaining pre-authorizations and the specific procedures for various insurance plans is equally vital.

Cross-training and collaboration

A collaborative culture between clinical, billing, and coding teams is essential for effective operations. Regular meetings should be held where groups can discuss challenges, share insights, and align processes. Allow billing and coding staff to shadow clinicians and gain firsthand knowledge of medical procedures and terminology. Additionally, create channels for staff to provide feedback on encountered denials and provide targeted training accordingly.

Regular audits and quality checks

Internal coding audits serve as proactive measures to identify potential causes before they result in denials. Healthcare providers should establish a schedule for regular internal audits and utilize software for automated quality checks.

Staying updated with regulations

With the constantly evolving nature of billing and coding regulations, staying updated with the latest guidelines is essential to prevent denials. Healthcare providers must remain informed of changing Centers for Medicare & Medicaid Services (CMS) regulations. Encourage staff to subscribe to newsletters, journals, or online resources that provide updates on regulatory changes. Ask the team to attend workshops or webinars to enhance their understanding further.

Establish communication and feedback loops

Healthcare providers should cultivate a collaborative environment where staff from different departments can openly communicate. Clinicians must understand how their documentation impacts billing, while billing staff should understand the clinical context. Regular meetings or training sessions should be conducted to facilitate discussions on denials, share best practices, and learn from each other's experiences.

Conclusion

Navigating the intricate world of claim denials in healthcare billing demands a strategic and proactive approach. From identifying the root causes of denials to implementing best practices for prevention, each step plays a pivotal role in optimizing revenue and streamlining operational efficiency. PCH Health has provided denial management solutions to healthcare providers for over 30 years. We offer tailored solutions to identify and resolve denials swiftly. Our denial management services improve coding accuracy and ensure ongoing compliance with evolving regulatory requirements. Do you want to know more about our denial management strategies? Connect with our denial management experts.