The healthcare insurance industry is on the verge of a profound digital transformation. Traditional business models are rapidly evolving to embrace new paradigms like connected insurance, usage-based premiums, and smart underwriting.

According to a recent survey, 95% of insurance executives plan to start or continue investing in AI. A McKinsey & Company report also indicates that AI-enabled payer organizations can automate 50-75% of manual tasks, allowing them to focus on complex cases and care delivery.

According to recent projections, AI is also set to positively impact insurance revenues by 3.2% to 7.1%.

While AI is transforming the payer domain in numerous ways, 91% of executives are worried about the forthcoming challenges with technological integration. This is where Generative AI steps in—GenAI allows robust security measures and leverages the existing data to provide intelligent solutions for exceptional patient care.

AI can also identify potential security threats and ensure adherence to privacy policies. Read this blog to learn more about how GenAI can revolutionize the payer domain.

What is the role of generative AI in payer management?

Generative AI is a game-changer, enabling computers to create new content, uncover insights in big data, and solve complex problems autonomously. Unlike traditional AI, which follows strict rules, Generative AI uses advanced techniques like natural language processing to think and learn more like humans.

For healthcare insurers, Generative AI brings exciting possibilities. It can help organize patient care better, make paperwork easier, analyze lots of data quickly, uncover new insights, and make smarter decisions.

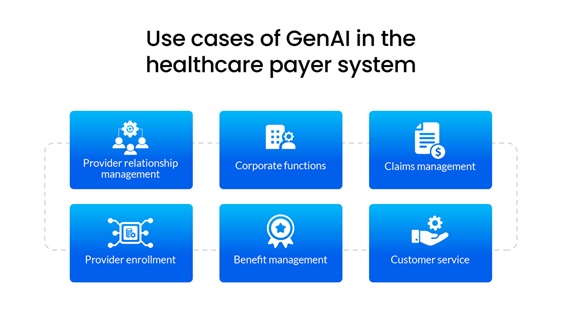

What are the use cases of GenAI in the healthcare payer system?

Provider relationship management

GenAI streamlines comparing plan/product features or networks, generating standard communications such as reports or notifications for new-member needs or claim denials. It efficiently identifies gaps in provider directories, ensuring open panels are promptly updated. Additionally, GenAI can also generate comprehensive reports and observations for providers and vendors, highlighting performance metrics and facilitating gap closure.

Corporate functions

GenAI streamlines HR self-service functions, handles initial inquiries, and provides onboarding guidance by showing the right interactive videos. It can efficiently synthesize requests for proposals (RFPs) and generate comprehensive responses. Drafting vendor communications is effortless with GenAI's help. It automates accounting tasks, swiftly extracting pertinent numerical data and generating standardized reports.

Keeping up with regulatory changes is simplified as GenAI internally summarizes updated risk and legal processes. Policyholders receive timely and comprehensive updates on regulatory changes, ensuring large-scale coverage. Redetermination processes are expedited with enhanced recurring eligibility screening summaries. Furthermore, GenAI generates insightful reports and key performance indicators (KPIs) across various functions, improving overall operational efficiency.

Claims management

GenAI streamlines the process of handling manual claims by generating concise summaries of the issues and identifying potential sources for resolution. GenAI can aggregate relevant information for complex claims through its advanced algorithms, facilitating quicker processing times. Additionally, it can also automate the generation of summaries and outcomes for prior authorization requests, saving valuable time and resources.

When drafting responses to appeals and grievances inquiries, GenAI assists by providing tailored suggestions and language, ensuring efficient and effective communication with stakeholders. Overall, the technology can revolutionize claim management by offering comprehensive support throughout the entire process, from issue identification to resolution and communication.

Provider enrollment

GenAI revolutionizes provider enrollment for payers by automating data processing, making intelligent decisions, and enhancing communication channels. It efficiently collects and analyzes provider credentials, ensuring compliance and qualification standards are met.

With customizable workflows, GenAI adapts to the unique needs of payers, optimizing efficiency and consistency. Seamless integration with existing systems allows better data consistency and eliminates silos. Through GenAI, payers experience faster enrollment turnaround times, reduced administrative burdens, and improved provider network management, ultimately delivering superior outcomes for both members and providers.

Benefit management

GenAI streamlines the process of providing personalized information on benefits, coverage, and claims to members. By harnessing patient data, intelligent systems can deliver tailored responses to inquiries, ensuring that members receive accurate and relevant information. This not only enhances efficiency but also improves member satisfaction by addressing their specific needs and concerns effectively.

Customer service

GenAI transforms the customer service experience by crafting tailored coverage summaries for benefit inquiries, whether online or through call center interactions.

AI-driven systems can generate dynamic call scripts and content for outbound communications, ensuring clarity and relevance. GenAI can also efficiently address service queries from both members and providers by deploying adaptive chatbots and smart routing systems.

Additionally, it offers intelligent clinician suggestions based on various parameters like coverage, location, preferences, and specific conditions, enhancing healthcare access and decision-making.

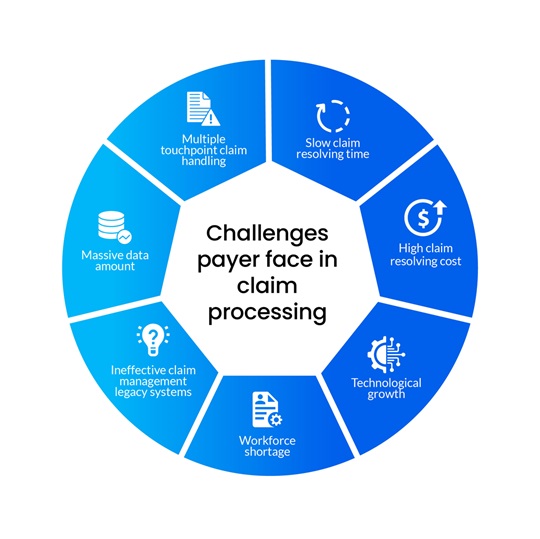

What are the challenges payers face in claim processing?

Massive data amount

Manual claim data processing is labor-intensive and time-consuming, often delaying the collection of necessary information and documents. Non-compliant electronic processing software can compromise security and threaten sensitive patient information. These challenges underscore the need for efficient and secure solutions to streamline claim data processing.

Multiple touchpoint claim handling

Miscommunication and the lack of a unified platform among stakeholders increase the likelihood of errors when transmitting data. This fragmented approach results in inefficiencies and a disjointed customer experience for providers and insurers, lacking the comprehensive 360-degree view necessary for effective decision-making and service delivery.

Slow claim resolving time

While state regulations mandate timely claim processing, real-world practices often deviate from these timelines. Delays in claim resolution are a primary challenge, frequently stemming from coding errors, investigation processes, and communication breakdowns among providers, carriers, and patients. These factors contribute to extended processing times, impacting the efficiency and effectiveness of the claim process.

High claim resolving cost

The claim resolution process involves a combination of manual and automated steps. Manual transactions incur higher costs than automated ones.

For instance, prior authorization remains primarily manual, resulting in significant administrative burdens and high costs associated with the process. Transitioning to a fully automated prior authorization process presents the most substantial opportunity for cost savings.

Slow technological growth

Staying ahead in the insurance industry means embracing cutting-edge solutions to enhance customer satisfaction, save costs, and improve the quality of work. Market dynamics drive the need to continuously update systems, deploy technologies aligned with key performance indicators (KPIs), and ensure the accuracy of the claim resolution process.

However, amidst the abundance of insurtech solutions, payers face the challenge of selecting the most suitable options while ensuring compliance with regulations like HIPAA. Integration with existing systems poses another hurdle, as both new and old technologies may require adjustments to meet industry standards.

Finding the right balance between innovation, compliance, and integration is essential for success in the evolving insurtech era.

Workforce shortage

Skilled data analysts possess a deep understanding of both business processes and the technical aspects of insurance analytics, but they are very expensive to recruit.

Effective data management is crucial for gaining a competitive edge, extracting insights, and expediting case resolution.

Many legacy systems still rely heavily on coding, making it increasingly difficult to find professionals with the necessary coding expertise. Moreover, manually handling claims requires a significant workforce that must undergo extensive training to perform the job efficiently.

Streamlining these processes through advanced data management and analytics reduces reliance on manual intervention and improves operational efficiency and decision-making capabilities.

Ineffective claim management legacy systems

Rigid legacy systems present several challenges:

- Finding specialists proficient in legacy system coding is increasingly difficult.

- Maintaining these systems consumes significant resources, and integrating new technology alongside the old incurs redundant costs.

- Their outdated nature can hinder your ability to meet evolving customer needs, potentially resulting in decreased competitiveness.

Upgrading or transitioning away from legacy systems is essential for staying agile, reducing costs, and aligning with modern customer expectations.

How does GenAI help fight claim processing challenges?

To overcome the challenges in insurance claims processing, businesses must embrace digital technologies such as GenAI. Continuing to resolve claims manually poses risks of prolonged processing times, escalating costs, and potential client dissatisfaction due to delays.

Leveraging digital solutions can streamline the process, expedite claim resolution, and enhance customer satisfaction.

Handling claims is a big deal in insurance. A poor customer experience can cost you customers. Almost nine out of 10 (87%) customers consider how well claims are managed before picking an insurance company.

Claims processing is the process where an insurance company receives, verifies, and deals with a report of a claim from a policyholder.

Moreover, claims impact customer satisfaction. Over 85% of customers who were unsatisfied with their last claims processing considered changing their providers.

Gen AI models can streamline claims management by automating responses for basic claim inquiries, shortening the time of processing insurance claims, and accelerating the overall claim settlement.

PCH Health: Revolutionizing the payer operations

At PCH Health, we're dedicated to revolutionizing healthcare operations through tailored solutions powered by advanced technology and extensive industry expertise.

Our innovative approach combines AI machine learning, robotic process automation, and invaluable industry knowledge to empower healthcare payers to streamline and automate their operations.

Whether it's optimizing claims management, enhancing customer support, or delivering personalized healthcare plans, PCH Health is your trusted partner for driving efficiency, improving outcomes, and navigating the complexities of the payer domain with ease. Here are our offerings:

- Member services and enrollment: From initial registration to ongoing management, our team leverages extensive knowledge to ensure that every member is accounted for accurately. Whether it's verifying credentials, updating information, or troubleshooting any issues that arise, we've got you covered.

- Payment integrity services: From meticulously reviewing claims to ensuring adherence to regulatory requirements, our team is dedicated to maintaining utmost accuracy and compliance throughout. We understand the complexities of reimbursement, and our experience allows us to navigate them with ease, saving you time and resources while mitigating risk.

- Claims administration: With our advanced systems and expert team, we ensure that every claim is handled with meticulous attention to detail. From verifying patient information to coding procedures accurately, we leave no stone unturned in ensuring that claims are processed swiftly and accurately.

- Provider administration and network management: Through our expansive network, you'll gain access to a diverse range of healthcare professionals, specialists, and facilities, all committed to delivering exceptional care. Whether you're seeking referrals, expanding your services, or simply connecting with like-minded professionals, our network provides the platform to do so.

Conclusion

According to the Centers for Medicare & Medicaid Services, without GenAI, a standard review can take up to 10 business days.

Additionally, 82% of patients are likely to abandon treatment after facing insurance struggles.

While there are many reasons to embrace Generative AI, businesses must consider its application carefully. PCH Health is a prominent player in the industry, ready to help you easily navigate the technological journey. Talk to our experts to learn more about getting started with GenAI.