Did you know inefficiencies in the revenue cycle can waste up to 15 cents of every dollar in healthcare? That’s a big chunk of change! To keep your finances in check, focusing on revenue integrity is key. According to the National Association of Healthcare Revenue Integrity (NAHRI), revenue integrity isn’t just about avoiding revenue leaks—it’s about making sure every patient visit adds up correctly. To stay on top, healthcare providers must boost operational efficiency, stay compliant, and have solid documentation and financial practices to withstand audits.

Previously, operations, compliance, and billing departments have worked in silos. There were distinct separations among personnel, processes, and systems in clinical, coding, and revenue cycle departments. This fragmentation made it challenging to find comprehensive solutions. Aligning these diverse entities to work cohesively throughout a patient’s clinical journey is essential for enhancing revenue integrity.

As revenue cycle management becomes more complex, healthcare leaders are increasingly prioritizing revenue integrity to address and prevent issues that lead to leakage. A robust revenue integrity program covers all aspects of the revenue cycle – boosting revenue, improving clean claim rates, and enhancing accuracy and compliance. This comprehensive blog will explore revenue integrity in depth, discuss how to align different entities, and examine its role in preventing leakage and improving compliance.

What are healthcare claims?

A healthcare claim is a document that medical professionals and organizations use to bill insurance providers. It is a formal request for payment submitted by healthcare providers to private or government payers for the services they have provided to patients. These claims detail the medical services rendered, including diagnoses, treatments, procedures, and medications.

Whenever a doctor sees a patient, they submit a claim to the insurance company to receive payment for their services. Accurate and timely submission of healthcare claims is crucial for healthcare providers to receive compensation for their services, ensuring they can continue to deliver quality care. Effective revenue integrity is essential in this process, as it helps manage claims, streamline operations, reduce administrative burdens, and improve overall financial performance. By focusing on revenue integrity, healthcare providers can navigate the complexities of claims management more efficiently and ensure financial stability.

The claims process

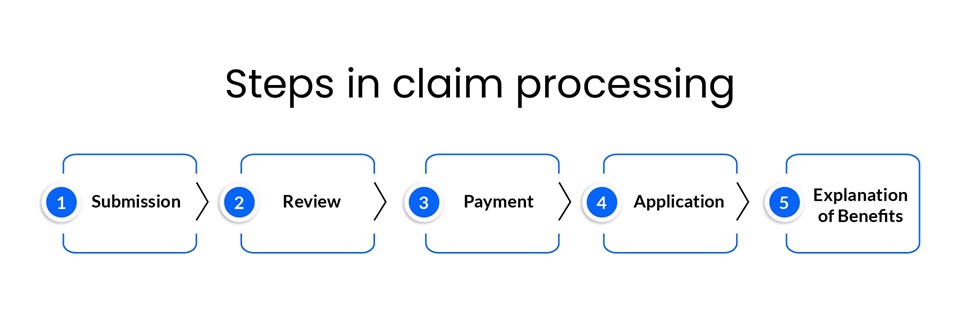

The claims process typically follows these steps:

Submission

The healthcare provider sends a bill for services rendered to the insurance company. The first step in the claim processing journey is submission. Healthcare providers generate claims based on the services rendered to patients. These claims include detailed information such as patient demographics, diagnosis codes, treatment details, and the costs associated with each service. Once the claim is accurately compiled, it is submitted electronically or via paper forms to the patient’s insurance company.

Review

A certified claims processor reviews the claim to ensure accuracy and validates it against the insurance plan to confirm whether the services rendered are covered by insurance. After submission, the claim enters the review stage. Insurance companies scrutinize the submitted claims to verify the accuracy and appropriateness of the provided information. They check for errors, inconsistencies, or missing information during this phase. This step may ascertain that the services provided were medically necessary and covered under the patient’s insurance policy. The review process ensures that only valid and accurate claims proceed to the next stage, minimizing the risk of fraud and errors.

Payment

The payer sends payment if the insurance plan covers the services. Depending on the type of insurance plan, they may pay the total amount or part of it, with the remaining balance billed to the patient. Once a claim passes the review stage, it moves to payment processing. The insurance company calculates the amount payable based on the patient’s coverage, the agreed-upon rates with the healthcare provider, and any applicable deductibles or copays. The payment amount is then disbursed to the healthcare provider. Depending on the insurance company’s policies and the accuracy of the submitted claim, this step can take anywhere from a few days to several weeks.

Application

The amounts are validated and applied to the deductible and out-of-pocket totals applicable to the insurance plan. In the application stage, the healthcare provider receives and applies the payment to the patient's account. This step involves updating the patient's billing records to reflect the received payment and any remaining balance the patient may owe. Accurate payment application is essential to maintaining clear and accurate financial records and ensuring that patients are billed correctly for any outstanding amounts.

Explanation of Benefits (EOB)

The Explanation of Benefits (EOB) is a document sent to the patient after claim processing. It details the services received, the amount covered by insurance, the payment made to the provider, and any remaining balance owed by the patient. Along with the EOB, a bill for the outstanding amount is typically issued. Clean healthcare claims ensure this process runs smoothly, minimizing delays and errors that can lead to revenue leakage and compliance issues.

The EOB is the final step in the claim processing cycle and serves as a transparent communication tool, helping patients understand how their claims were processed and how much they are responsible for paying out-of-pocket.

Understanding revenue leakage in healthcare

According to the University of North Carolina's Cecil G. Sheps Center for Health Services Research, about 20% of rural hospitals were on the brink of closure in 2019, and 40% were operating at a loss. Academic medical centers, which deliver 25% of the nation's healthcare, have suffered despite additional funding sources. Rural hospitals were also in a precarious position. All of this was because of revenue leakage, which could happen for multiple reasons. However, here are some critical pointers for healthcare providers to remember.

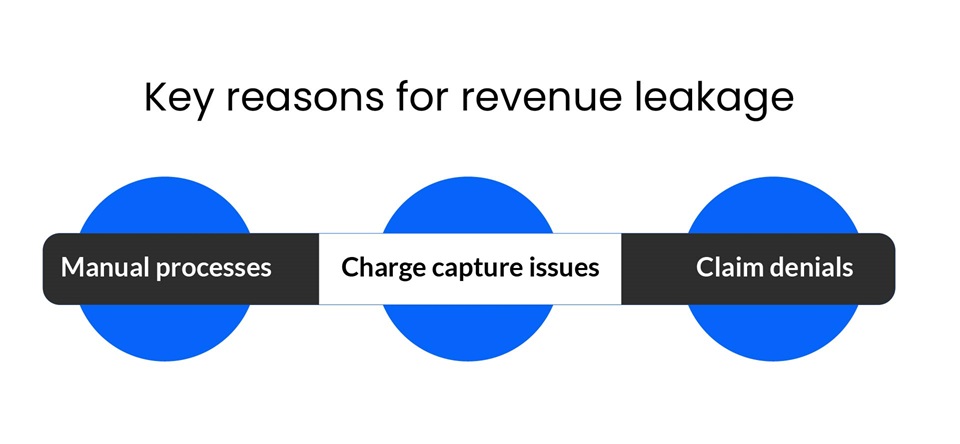

Critical reasons for revenue leakage

Manual processes

Due to additional time and resources, manual RCM processes between providers and payers are costlier than electronic transactions. According to the Council for Affordable Quality Healthcare (CAQH), manually checking claim status can cost an additional $3.59 per claim, and each manual remittance advice costs $4.74 more. These manual processes involve data entry, documentation, medical coding, and claim submission. Automating these repetitive tasks is vital for saving staff time and preventing revenue leakage.

Charge capture issues

Charge capture issues can cost up to 1% of annual net revenue. For a hospital generating $750 million per year, this could translate to $7.5 million in lost revenue due to missing charges. These issues often stem from improper documentation or data entry errors, as well as inaccuracies in medical coding. To mitigate charge capture issues and prevent revenue leakage, healthcare providers should adhere to revenue integrity practices and ensure meticulous documentation and coding.

Claim denials

More than 20% of healthcare claims are routinely denied, making claim denials one of the largest sources of revenue leakage. Claim denials happen for multiple reasons, such as improper coding, late submission, and incomplete documentation. To address this, healthcare providers must identify trends, stay compliant, and leverage automation for effective claims management. Prompt resubmission of denied claims is also essential to minimize revenue loss.

What happens when a claim is denied?

When a payer denies a claim, it becomes significantly more challenging for the healthcare provider to recover the payment they are owed. According to one study, 11% of medical claims are denied on first submission. The same analysis found that hospitals experienced a 23% increase in claim denials in 2020 compared to 2016. Another study indicated that $262 billion in medical claims were initially denied in 2016.

The Healthcare Business Management Association (HBMA) reports that 60% of denied claims are never appealed, drastically reducing the likelihood that healthcare providers will ever receive payment for those services. Even minor medical coding and billing errors can result in claim rejections, posing a significant challenge to medical organizations' revenue streams.

Why do so many denied claims go undisputed?

Many denied claims go undisputed due to the complexity and administrative burden involved in the appeal process. Healthcare providers must gather extensive documentation, complete detailed forms, and navigate strict procedures and deadlines set by insurance companies, which can be time-consuming and resource-intensive. Additionally, smaller practices may lack the dedicated staff to manage appeals effectively. Disputing rejected or denied claims is costly; one study found that it costs $118 per claim to appeal, totaling $8.6 billion in appeals-related administrative costs. The financial return on disputed claims often does not justify the effort and resources needed to pursue them.

This combination of administrative complexity, resource constraints, and cost-benefit considerations leads many providers to forgo disputing denied claims, resulting in significant lost revenue. These challenges underscore the importance of clean claims and robust revenue integrity practices to minimize denials and streamline the appeals process when necessary.

How does revenue integrity help minimize claim denials?

Inaccuracies and errors that lead to denied claims are responsible for significant lost revenue for healthcare providers. Correcting and resubmitting these claims can be costly and time-consuming for providers and payers. To mitigate these issues, many healthcare providers partner with claims processing companies like PCH Health

Revenue integrity plays a crucial role in reducing and avoiding claim denials by ensuring that all aspects of the revenue cycle are accurately managed and compliant with regulations. Here’s how:

Ensuring accurate documentation

Accurate documentation is critical for submitting clean claims that meet payer requirements, reducing the risk of denial due to incomplete or incorrect information. Revenue integrity involves meticulously documenting patient information, treatments, diagnoses, and services.

Compliance with regulations

Adhering to healthcare regulations and payer policies is a core aspect of revenue integrity. This includes staying updated with changes in coding standards, billing rules, and payer requirements. By ensuring compliance, healthcare providers can avoid claim denials that arise from non-compliance with these standards.

Effective coding and billing

Proper coding and billing practices are essential components of revenue integrity. This includes using the correct diagnosis and procedure codes, ensuring that codes match the services rendered, and avoiding upcoding or undercoding. Accurate coding and billing reduce the likelihood of denials due to coding errors.

Regular audits and monitoring

Regular audits and monitoring of the revenue cycle processes help identify potential issues before they lead to claim denials. Audits can uncover discrepancies, compliance issues, and areas for improvement.

Training and education

Investing in training and education for revenue cycle staff is a key aspect of maintaining revenue integrity. Educated staff are more likely to understand and adhere to proper billing and coding practices, reducing errors that can lead to claim denials.

Technology and automation

Advanced technology and automation tools can enhance revenue integrity by streamlining processes, ensuring accuracy, and improving efficiency. Automated systems can help with real-time verification of patient eligibility, correct coding, and timely claim submission, all of which contribute to reducing denials.

Denial management

Revenue integrity also involves a robust denial management strategy. This includes analyzing denial trends, identifying root causes, and implementing corrective actions. By understanding why claims are denied and addressing these issues, healthcare providers can reduce future denials.

How does improper revenue integrity lead to underpayments in healthcare?

According to the American Medical Association's Health Insurance Report Card, the complexity of the reimbursement and coding system has led to payment accuracy rates among insurance companies dropping as low as 77 percent. This happens due to inefficient revenue integrity, which leads to underpayment. Underpayments occur when there is a difference between a claim's expected payer value and the actual payments received.

Payment variances are more common than many might expect. The Medical Group Management Association (MGMA) estimates that insurers frequently underpay healthcare providers by approximately 7-11%. It's important to note that not all payment variances are underpayments; sometimes, overpayments also occur.

How can revenue integrity address overpayments?

Accurate and thorough revenue integrity management benefits healthcare providers and helps identify and prevent overpayments. Research suggests that up to 3% of all healthcare claims can result in overpayment. While there are established and legally enforceable methods for insurance companies to reclaim overpaid funds, this process can be expensive and time-consuming for all parties involved. Effective revenue integrity practices can help mitigate these issues by reducing or eliminating overpayments.

Revenue integrity challenges for healthcare providers

Healthcare spending in the United States dropped by 18% during the first three months of 2020, the steepest decline since 1959, according to the U.S. Chamber of Commerce.

The pandemic accelerated the adoption of telehealth services. Between mid-March and mid-October 2020, over 24 million Medicare beneficiaries utilized telehealth options, a notable increase from pre-COVID levels. Although telehealth enhances patient care and convenience, it also complicates medical coding and claims submissions.

While busier times often lead to increased revenue for many businesses, healthcare providers face unique challenges, such as escalating billing complexities and rising care costs, all of which are linked to ineffective revenue integrity. Addressing these revenue integrity challenges requires significant investments in technology, infrastructure, and personal protective equipment (PPE).

In response, healthcare decision-makers are now focusing on implementing new revenue integrity strategies to tighten the revenue cycle and increase reimbursement. This entails enhancing in-house accounts receivable processes or partnering with experienced revenue integrity service providers. Such partnerships offer industry-specific expertise, enabling providers to focus on their core competencies, like patient care.

PCH Health’s approach to revenue integrity

As the healthcare industry evolves, revenue integrity is becoming increasingly crucial. Leveraging advancements in AI, RPA, and machine learning, predictive and proactive revenue integrity strategies allow healthcare providers to stay ahead of coding errors and denials, ensuring continued operations and protecting their bottom line.

With over 30 years of industry experience, PCH Health excels in identifying and correcting unrecognized revenue for healthcare clients. We have recovered over $4 billion for our provider clients, boosting their bottom line by 2%- 5% of net patient service revenue. Our services include contract management, underpayment identification and recovery, contract modeling, denials management, data mining, analytics, and reporting.

Contact us today to learn how our comprehensive revenue integrity solutions can help your organization prevent revenue leakage and enhance compliance.