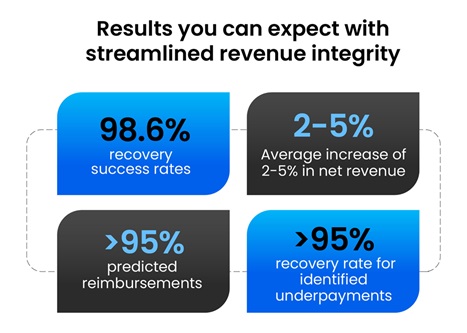

Revenue integrity is vital in healthcare RCM workflows to optimize cash flow, improve compliance, and reduce revenue leakages. Streamlined revenue integrity ensures accurate and timely reimbursement for healthcare providers' services to patients.

Importance of revenue integrity

In 2024, maintaining revenue integrity has become crucial. Here's why:

Financial stability:

Healthcare providers' financial stability depends on reimbursements. Improper revenue integrity causes:

- Medical billing errors

- Claim denials

- Incomplete payments

All resulting in significant revenue losses.

Regulatory compliance:

The healthcare industry is subject to numerous regulations and guidelines. Ensuring revenue integrity helps healthcare providers comply with HIPAA, Medicare, and Medicaid regulations.

Optimized operations:

A robust revenue integrity strategy can streamline RCM processes. It also reduces billing errors and enhances operational efficiency for healthcare providers.

Data-driven decision-making:

Revenue integrity involves leveraging data analytics to gain insights into the RCM process. It helps healthcare practices identify denial trends, cracks in the revenue cycle, and potential risks.

Let's understand more about revenue integrity. This blog aims to describe everything about revenue integrity in healthcare. We will focus on its benefits, challenges, and best practices.

What is revenue integrity?

Revenue integrity aims to identify and rectify issues in the RCM process that could lead to:

- Revenue loss

- Compliance risks

- Inefficiencies

It involves strategically managing the RCM process, from patient registration to claim submission and payment collections.

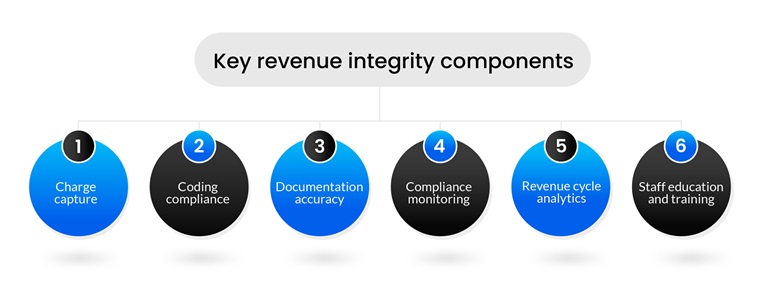

Revenue integrity encompasses various aspects of financial and operational functions. Here are the key revenue integrity components:

Charge capture

Accurately capture all billable services and procedures offered to patients. Charge capture includes:

- Finding and rectifying missing charges

- Ensuring that all services rendered are documented and coded correctly.

- Reviewing the net revenue potential of charges captured

Coding compliance

Proper use of medical codes and modifiers is essential for accurate billing and reimbursement. Staying compliant with coding includes:

- Adhering to Current Procedural Terminology (CPT) and International Classification of Diseases (ICD) coding guidelines.

- Regular training for medical coders to stay updated with code sets and changes in regulations.

- Conducting regular medical coding audits to identify errors or compliance issues.

Documentation accuracy

Thorough and accurate documentation is crucial for reimbursements. It involves:

- Ensuring that medical records contain precise information about the services provided.

- Capturing the medical necessity of procedures and services to support billing.

- Implementing documentation improvement strategies to enhance accuracy.

Compliance monitoring

Healthcare providers must comply with regulatory guidelines. Key areas of focus include:

- Monitoring compliance with Medicare, Medicaid, and third-party payer requirements.

- Conducting internal audits and reviews to identify gaps.

- Implementing corrective programs to address compliance issues.

Revenue cycle analytics

Leveraging advanced analytics and automation is crucial for streamlined revenue integrity. It involves:

- Analyzing key performance indicators (KPIs).

- Utilizing advanced analytics and AI to forecast reimbursements, identify potential risks, and optimize workflows.

- Implementing dashboards and reporting tools for real-time visibility into the revenue cycle.

Staff education and training

A well-trained and experienced workforce is essential for maintaining revenue integrity. It includes:

- Providing ongoing education on medical coding, clinical documentation, and compliance.

- Ensuring that staff understand the importance of their roles in the practice.

- Offering training to keep staff updated on industry changes and best practices.

Focusing on these critical components aids healthcare providers in establishing a solid foundation for revenue integrity. However, optimized revenue integrity is more complex than it looks. It comes with challenges.

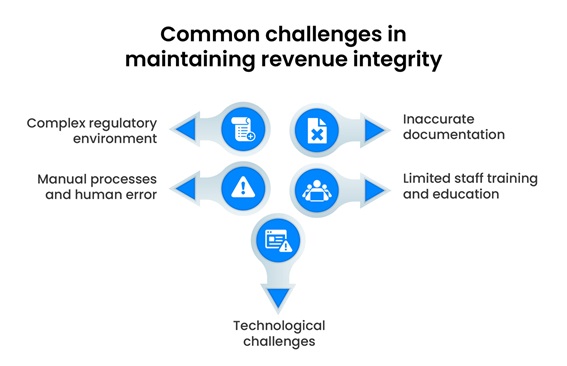

Revenue cycle management healthcare challenges in maintaining revenue integrity

There are numerous revenue cycle management healthcare challenges that practices face while maintaining revenue integrity. Some of the common hurdles include:

Complex regulatory environment

The healthcare industry is heavily regulated, with frequent changes in coding guidelines, billing rules, and compliance requirements. Keeping up with these changes can take significant time and effort.

Inaccurate documentation

Insufficient or inaccurate documentation can cause medical billing and coding errors, leading to claim denials and compliance issues.

Manual processes and human error

Dependence on manual data entry and RCM processes increases the risk of error, which can result in inaccuracies and revenue loss.

Limited staff training and education

Lack of ongoing training on coding updates, compliance regulations, and best practices can hinder the billing process and result in denials.

Technological challenges

Implementing and integrating new Revenue Cycle Management solutions or software can be complex and time-consuming.

Best practices for revenue integrity

Healthcare providers can fight these challenges with a streamlined revenue integrity process procedure. Revenue integrity best practices can help healthcare providers establish an optimized RCM process. These strategies enhance financial performance, compliance, operational efficiency, and patient care delivery.

Data analytics and monitoring

Healthcare providers should use advanced analytics and automation to improve compliance and billing consistency. They should analyze claims to check the accuracy of CPT and HCPCS codes, as well as DRGs. Practices must implement tech-enabled systems that can detect missing reimbursements and manage rebilling. Systems must provide instant visibility into metrics such as claim denial rates, days in accounts receivable, and revenue per patient. It allows quick interventions and optimizations.

Charge capture optimization

Healthcare providers must review and streamline the entire charge capture workflow, including:

- HIM code review

- Charge capture

- Transfer DRG review

- Contract management

- Payment variance analysis.

They must invest in technology solutions that automate charge capture, ensuring accuracy and timeliness while minimizing manual intervention.

Compliance and documentation

Healthcare providers must stay updated on evolving regulations, payer guidelines, and coding updates. They must also understand the importance of comprehensive and precise documentation. Precise documentation is needed for the successful completion of every cycle in the RCM process, from patient resignation to collection.

Staff training and education

Healthcare providers should offer regular training sessions, workshops, and resources for the staff. They must also encourage an environment where staff members collaborate and work toward a common goal of practice growth.

Technology integration

Implement an integrated RCM system centralizing the following procedures for seamless operations.

- Medical billing

- Medical coding

- Claims processing

- Payment reconciliation

Healthcare providers should leverage artificial intelligence and automation tools to optimize repetitive tasks, identify errors, and streamline RCM.

Technology Solutions for Revenue Integrity

Technology plays an important role in maintaining revenue integrity. Healthcare providers can leverage various technology solutions to streamline their revenue cycle, reduce errors, and optimize reimbursement. Some of the key technology solutions for revenue integrity include:

- Automated Coding and Billing Systems: These systems use artificial intelligence (AI) and machine learning (ML) to automate the coding and billing process, while reducing errors and increasing efficiency.

- Predictive Analytics: Predictive analytics tools use data and statistical models to forecast patient outcomes, identify potential revenue cycle disruptions, and optimize reimbursement.

- Revenue Cycle Management (RCM) Software: RCM software integrates various aspects of the revenue cycle, including patient registration, charge capture, and claims processing, to provide a comprehensive view of the revenue cycle.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML can be used to analyze large datasets, identify patterns, and make predictions, helping healthcare providers to optimize their revenue cycle and reduce errors.

Revenue Integrity in Healthcare and Patient Engagement

Revenue integrity is not just about optimizing reimbursement; it's also about providing transparent and patient-centered care. When healthcare providers prioritize revenue integrity, they can also improve patient engagement and satisfaction. Here are some ways revenue integrity can impact patient engagement:

- Transparent Billing: Accurate and transparent billing helps patients understand their financial responsibilities, reducing confusion and anxiety.

- Improved Communication: Revenue integrity requires clear communication between healthcare providers, patients, and payers. This improved communication can lead to better patient engagement and satisfaction.

- Patient-Centered Care: By prioritizing revenue integrity, healthcare providers can focus on delivering patient-centered care, which is essential for improving patient engagement and outcomes.

- Reducing Financial Stress: Revenue integrity can help reduce financial stress for patients by ensuring accurate and timely billing, which can improve patient satisfaction and engagement.

By prioritizing revenue integrity and patient engagement, healthcare providers can create a positive patient experience, improve outcomes, and enhance their reputation.

Future Trends in Revenue Integrity

Revenue integrity solutions are becoming indispensable for healthcare providers aiming to enhance financial performance and maintain compliance. As the industry evolves, these solutions will be crucial in safeguarding against revenue leakage, ensuring accurate coding, and verifying that all services rendered are reimbursed appropriately. By integrating advanced healthcare revenue integrity practices, organizations can navigate the complexities of today's healthcare environment, ensuring that their financial and operational goals are met while delivering superior patient care.

The future of revenue integrity lies in predictive analytics, where healthcare providers can detect:

- Revenue-generating opportunities

- Identify potential risks

- Make informed decisions.

Advanced analytics tools will enable healthcare providers to forecast reimbursement patterns, optimize billing strategies, and eliminate denials before they occur. By leveraging predictive analytics, practices can stay ahead of financial challenges and maximize cash flow for sustainable economic growth.

As the shift towards value-based care continues, revenue integrity will be crucial in aligning financial incentives with patient outcomes. Healthcare providers must accurately document patient services and outcomes to ensure proper reimbursement. Revenue integrity strategies will evolve to emphasize the correlation between financial performance and the delivery of high-quality, cost-effective care.

In this dynamic healthcare RCM world, PCH Health understands the crucial role of revenue integrity. We know healthcare providers' complexities and challenges in RCM. Our experts offer tailored revenue integrity services to optimize your revenue cycle, ensuring maximum financial performance.

From charge capture to payment variance analysis, we offer all the solutions and expertise needed. Our experts help healthcare providers stay ahead of industry changes and proactively address revenue challenges. Contact PCH Health today to learn more.