Financial sustainability is critical in healthcare settings. As critical as patient care.

If you want to be a part of a team of experts engaged in revenue cycle management of hospitals and other healthcare practices, a certification might give you an edge. This is where Certified Revenue Cycle Representatives (CRCR) comes into play.

The certification is a gold standard for professionals working in healthcare RCM settings. It is offered by Healthcare Financial Management Association (HFMA).

But what does the certification really involve?

It essentially validates the expertise in managing financial transactions, process improvement, and ensuring compliance with healthcare regulations. So, if you are a budding healthcare financial professional, this certification might be a good addition to your resume.

This guide explores a couple of things:

- First we understand what CRCR is and its importance

- Then we look into the key areas covered in CRCR

- This is followed by a guide on how to achieve the CRCR certification

- And finally the future trends

What is CRCR certification

The CRCR is a nationally recognized credential that’s designed to standardize knowledge as well as competencies for professionals dealing with revenue cycle. Take patient registration to final payment collection - CRCR professionals are equipped to handle the revenue cycle at every stage of the billing process.

Providers, payers and patients interact in various ways and touchpoints when it comes to financial transactions. It has its own set of problems.

Mismanagement at any stage of the billing process could lead to delayed reimbursements, financial losses or even compliance violations. CRCR-certified professionals thus act as experts who can ensure compliance and improved cash flow in an organization.

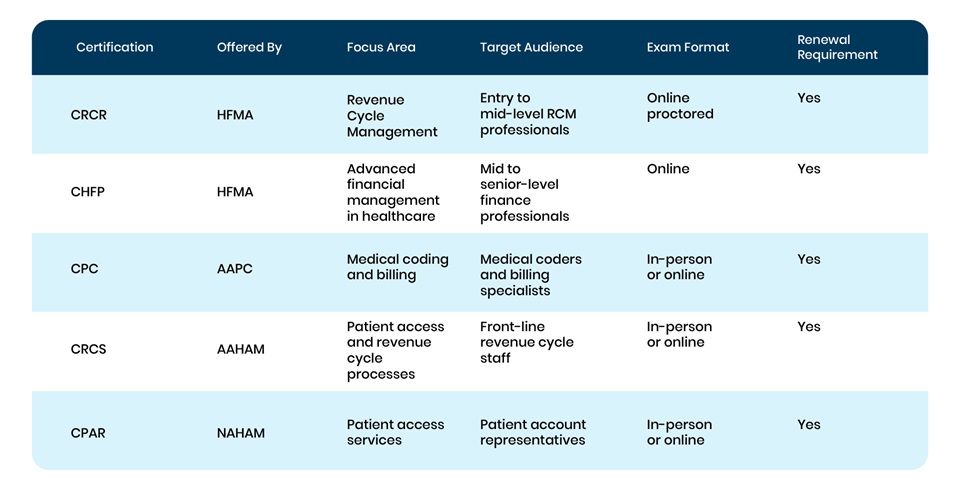

However there are multiple credentials available for healthcare financial professionals. Why then opt for CRCR?

The first reason you should choose CRCR is because of its broader scope. CRCR covers all aspects of revenue cycle management, while the other certificates such as CPC and CPAR focus more on coding and patient access, respectively.

CRCR is also suitable for entry-to-mid level professionals as opposed to CHFP being the right choice for senior level professionals. It’s a great starting point for anyone looking to dive deeper into revenue cycle management.

It is no surprise then that CRCR is widely considered to be a valuable asset for people in healthcare finance roles.

Is CRCR certification worth it?

The answer to what makes CRCR certification important lies in its ability to validate expertise in nuances of revenue cycle operations.

Hospitals and healthcare providers are increasingly struggling with claim denials. A CRCR professional can then play the role of risk mitigator and ensure better financial performance.

Even experienced professionals may not have formal training in revenue cycle management. CRCR certification provides structured learning on patient financial services, regulatory compliance, and revenue cycle analytics, ensuring a well-rounded understanding of the field.

Then there is also the case of stringent compliance requirements in the form of HIPAA, Medicare, Medicaid, and fraud prevention laws. CRCR-certified professionals are trained to handle these regulations, reducing legal risks.

This is why the healthcare industry values a CRCR professional and it increases employability, opens doors for promotion and can enhance earning potential.

Key Areas Covered in CRCR Certification

Patient Access and Registration

Why is patient access and registration such an important component of the certification? For one, it’s a crucial starting point of the revenue cycle. It ensures that accurate patient data is collected upfront.

This includes everything from verifying demographic details, insurance eligibility, and to checking financial responsibility before submitting any claim. It’s important to avoid any errors at this stage.

Why? It can lead to claim denials and billing issues down the line.

CRCR certification trains professionals to manage patient intake, ensure proper pre-authorization, and provide financial counseling to minimize unpaid balances.

Revenue Integrity and Compliance

Revenue integrity is all about healthcare providers charging correctly for the services rendered while maintaining compliance with regulatory requirements such as HIPAA, Medicare and Medicaid.

It is important to avoid both underbilling or overbilling, since both can lead to revenue losses or legal consequences.

What does that mean? That means proper charge capture, coding, and clinic documentation are essential elements of the billing process and the certificate ensures adequate training on these.

CRCR-certified professionals learn best practices in maintaining compliance, preventing fraud, and ensuring that claims are correctly documented and submitted.

Billing and Collections

Billing and collections are at the heart of revenue cycle management and so this certification ensures that you have the expertise for effective timely payments.

The certifications cover every aspect of this process - be it claim submission and payment posting to denial management and account reconciliation.

It’s essential that revenue cycle professionals work closely with insurance companies, government programs, and patients to minimize outstanding receivables.

How can it be avoided? Understanding patient statement processing and debt collection strategies is also a key part of this training.

Revenue Cycle Analytics and Reporting

Data analytics plays an increasingly vital role in optimizing revenue cycle processes.

But one has to wonder how the certificate ensures this expertise?

CRCR certification includes training on how to analyze Key Performance Indicators (KPIs) such as denial rates, days in accounts receivable, and net collection rates.

Revenue cycle professionals can identify inefficiencies, detect revenue leakage, and implement process improvements by using the insights gained from these reports.

How to Become a Certified Revenue Cycle Representative

Eligibility Requirements

To be eligible for the CRCR certification, candidates should meet the following criteria:

- A background in healthcare finance, revenue cycle management, or a related field.

- At least one year of experience in revenue cycle operations is recommended but not mandatory.

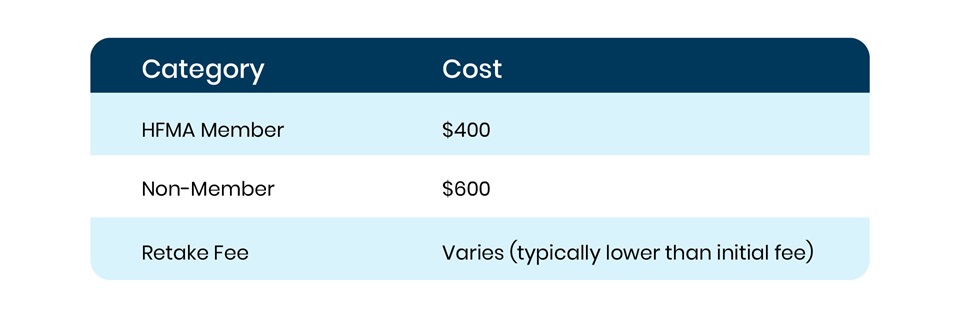

- HFMA membership (though non-members can also apply at a higher fee).

Certification Cost

The certification fee includes the study materials and access to the online examination.

What are the steps to become a CRCR professional?

- Ensure you meet the basic requirements, such as industry experience or an interest in revenue cycle management as given in the eligibility section.

- Sign up through the HFMA website and pay the necessary fees.

- Use HFMA-provided materials, online courses, and practice exams.

- The CRCR certification exam is an online proctored assessment covering key revenue cycle topics.

- Upon successful completion, receive your official CRCR designation.

- Renew certification as required to keep credentials valid.

A solid foundation in the key components as described earlier along with the steps given above will ensure that you become a certified CRCR professional.

It is no doubt it is an essential credential for healthcare finance professionals, and thus a valuable addition to their expertise. PCH Health offers such expertise in the form of expert coders, denial management professionals, and revenue cycle management experts. Contact us to try the demo.