Revenue cycle management strategies: Overview, challenges, and implementation tips

Financial stability is crucial for healthcare providers to offer a seamless patient experience and grow as an organization. Defining a revenue cycle strategy is vital. It helps to increase financial health and enhances operational efficiency for healthcare providers. In this blog post, you will learn about the challenges healthcare organizations commonly face in optimizing their revenue cycle, the importance of a revenue cycle strategy, and how it can provide an effective revenue cycle management solution for all your needs.

Understanding the revenue cycle

The revenue cycle is the process of generating revenue for healthcare providers' services. Revenue cycle management (RCM) is a journey that begins when a patient seeks care and extends to collecting payments for services provided. Here are the critical revenue cycle components needed to define a proactive strategy.

Patient registration

Patient registration marks the initiation of the revenue cycle. It involves gathering essential demographic and insurance details to increase accuracy.

Medical coding

Medical coding translates diagnoses and procedures into universal alphanumeric codes. Accurate coding is vital for proper billing and reimbursement. It reduces the risk of claim denials while increasing healthcare providers' cash flow.

Medical billing

Medical billing includes submitting claims to insurance payers. Timely and accurate billing minimizes payment delays, ensuring a steady cash flow.

Payment collection

Optimizing the revenue cycle requires efficient follow-up on unpaid claims and patient balances. This phase involves collecting outstanding payments from plans or patients.

Challenges in Revenue Cycle Management

Revenue cycle management has its challenges. These challenges range from coding errors and claim denials to evolving regulations and payer complexities. These hurdles can lead to revenue leaks, delayed payments, and increased administrative burden.

Complex billing processes

According to Equifax, over 13% of the medical bills contain errors. Medical billing is a complex process. It comprises multiple payer requirements, coding regulations, and varied reimbursement models. Even the slightest errors in these processes can lead to payment delays.

Data integration issues

Multiple systems for patient records, billing, and financial management create inefficiencies and hinder data-driven decision-making.

Rising healthcare costs

The increased cost of care has decreased reimbursements for healthcare providers. According to Forbes, almost half of US residents carry medical debt. Practices must find ways to optimize revenue streams, maximize reimbursements from the payer, and collect patient payments.

Staffing and training needs

Adequately trained staff are essential to optimize the revenue cycle management process. According to Beckers, more than 60% of healthcare providers have skilled staff shortage. Healthcare providers face challenges in hiring and retaining skilled professionals.

Technology advancements

Staying updated with evolving technologies such as Electronic Health Records (EHRs) and revenue cycle management software requires continuous investment and training. However, due to their busy schedules, healthcare providers often fail to stay updated with these technological advancements.

Why do effective RCM strategies matter?

Effective RCM strategies matter as they are the pillars of effective practice growth. Poorly managed RCM can lead to revenue leaks, delayed payments, and increased administrative burdens. With the right strategies, healthcare providers can:

- Reduce claim denials by ensuring accurate medical coding.

- Enhance cash flow by minimizing payment delays.

- Improve patient satisfaction with clear billing processes.

- Stay compliant with ever-evolving healthcare regulations.

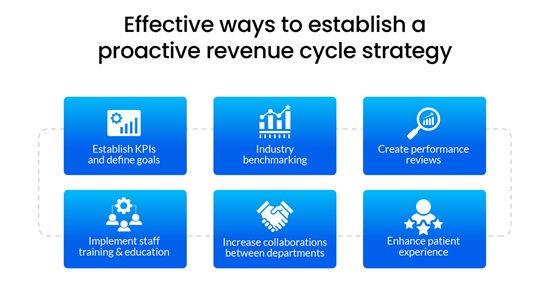

How do we establish a proactive revenue cycle strategy?

Revenue cycle management strategies aids healthcare providers in combating RCM challenges. Practices can save resources and invest the same in other important tasks like providing premium care to patients. Here are 6 effective e revenue cycle strategies.

Establish KPIs and define goals.

Healthcare providers must define goals and establish KPIs (Key Performance Indicators) for a proactive revenue cycle strategy. Practices must analyze previous data and take prompt actions depending on the reports. Healthcare providers can identify trends and problem areas to define a breakeven point to measure progress.

As the practice moves swiftly towards the goal, provide clear instructions to the staff and focus on critical areas. Each healthcare provider might have a unique goal, but they should avoid putting too many KPIs on the list and keep them achievable.

After defining KPIs, it is vital to keep track of them. KPIs aid healthcare providers in:

- Identifying issues and opportunities,

- Monitoring financial health,

- Providing direction and focus areas,

- Measuring progress

Common KPIs tracked while building a proactive revenue cycle strategy include:

- Revenue per visit

- Days in accounts receivable A/R

- Collections ratio

- Unapplied credits

Industry benchmarking

Once the KPIs are defined, it is vital for healthcare providers to implement best practices. Start by defining data to create KPIs and outline the tracking analysis. Data is vital to identify trends and areas of concern. It helps healthcare providers establish baselines and measure progress. Practices must keep track of missing data, take steps to understand why data is missing, and find ways to revive the data.

Once the data is collected, healthcare providers can compare it with historical performance and industry benchmarks. Practices can understand their current position and create a procedure to achieve the desired level of performance. Historical data tracking also helps gain insights into trends and an organization's progress over time.

Healthcare providers should create visual representations of the trends to increase readability, visibility, and accessibility. Visual representations help detect critical findings quicker and send them to the required team.

Create performance reviews

Healthcare providers should regularly review their practices' financial performance to understand their overall health. Reviews aid providers in identifying bottlenecks, implementing corrective actions promptly, and monitoring overall progress. Practices can identify revenue cycle issues early and swiftly eliminate them.

Once the proactive A/R strategy is implemented, KPIs are outlined, and goals are completed. A checklist with responsible parties, target dates, and assigned tasks should be used. Share the checklist within the practice to identify productivity gaps and update the data accordingly.

Implement staff training and education.

Healthcare providers must ensure the staff is updated with the latest compliance guidelines and regulatory changes. Provide the staff with training sessions, workshops, or online courses. Foster a culture where staff members take ownership of their roles in the revenue cycle. Healthcare providers should encourage and reward accountability for accurate documentation, coding, and billing practices. Implementing staff training and education will ensure that the organization complies with all the regulations and that the complete process is streamlined.

Increase collaborations between departments.

Healthcare providers must encourage open communication between billing, coding, and clinical departments. They should have a culture of collaboration and shared responsibility for revenue cycle success. Practices must also establish cross-functional teams to address specific revenue cycle challenges. The cross-functional team should include representatives from different departments to brainstorm solutions and implement best practices collaboratively. Increasing collaboration will reduce the back-and-forth for changes or approvals. Staff would have transparency of the work and would promptly know the results of their actions.

Enhance patient experience

Practices must provide a clear and understandable explanation of the bills, breaking down insurance coverage, out-of-pocket costs, and charges. Patients should have multiple payment options, like online portals, credit card payments, and payment plans. The payment process should have simplified options, as they encourage timely payments. Healthcare providers should also give patients access to financial counselors who can assist with insurance questions and payment arrangements. This helps patients understand their financial responsibilities and options.

Conclusion

A revenue cycle strategy helps healthcare providers enhance their financial health. A proactive revenue cycle strategy goes beyond financial management; it is the building block for sustainable growth and improved patient outcomes. PCH Health addresses financial processes for healthcare providers and streamlines growth. We help you predict and manage cash flows better.

Our RCM solutions optimize cash flow and reduce administrative burden, allowing your staff to focus more on patient care. We have transparent billing processes, accurate cost estimates, and clear communication for a positive patient experience. Stay ahead of regulatory changes and compliance requirements with PCH Health. Click here to get started.